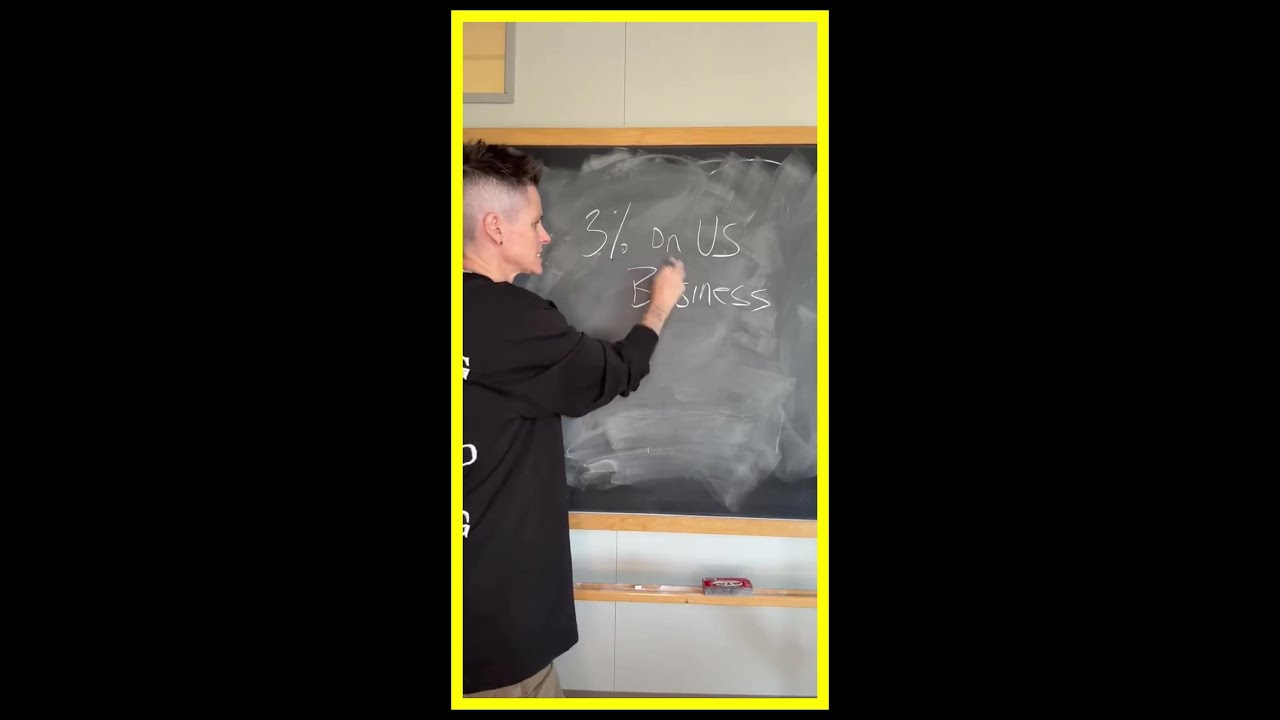

This video has a really good explanation about how tariffs work, with a simple 3% example. Trump says it’s the most beautiful word there is and he keeps pushing it as only the country exporting to the U.S. pays the extra cost. Any further and/or detrimental effects will be negated by how much money will be coming into the Treasury.

Watch the video and continue reading.

If you’ve got a Treasury agent standing right there to collect the 3% at the time the goods are received, that’s still an extra cost paid by the U.S. company. It isn’t like the cost stays the same for the U.S. company and Uncle Sam goes to the exporting country and gets the 3% directly from them, lowering what they earned from the sale to 97% of the intended price.

The actual scenario is the cost of the goods becomes 103%. The U.S. company pays 3% more and the exporting country still gets 100% of what they were expecting to sell the goods for. The result is the tariff money goes from the U.S. company to the U.S. government. The only negative effect for the other country is if U.S. companies reduce what they buy from those places. Some companies may not be able to and they’re stuck with the imported goods.

I’m going to take the choice the U.S. company has to make and add another layer.

Choice A is to absorb the increased cost of the goods, which causes their profit margins to go down, which hurts their stock price if they are a publicly-traded company. Shareholders don’t like seeing the stock price go down, even if it’s a tiny amount.

That leaves them with Choice B: pass the increased cost onto their customers, Joe and Jane Consumer in the U.S. If costs on necessities go up, then Joe and Jane reduce discretionary spending, which hurts other businesses like restaurants, entertainment, and more.

You know which choice companies went with for the tariffs Trump put in place as president? It wasn’t just B. Those companies chose B, but other companies that weren’t affected as much saw the opportunity to raise their own prices, partially due to the perception that a lower-cost item is a lower-quality item, even if they are at the same quality level as they were before.

The video addresses the assumed intent of a tariff: bring manufacturing back into the country so they don’t have to import as much. The problem is time. Besides increased regulations, wages, unions, etc., it take time to build a manufacturing plant.

You either keep paying the increased cost on imports due to the tariff until you get that plant up and running so your output stays the same, or you reduce your imports and reduce your output, which creates shortages, which drives up prices.

Trump has said he doesn’t want to be remembered like Herbert Hoover is. Since he won’t back down on tariffs, he will be.

It was during Hoover’s time as president that the Tariff Act of 1930 was implemented, placing a tariff on over 20,000 imported goods. The U.S. tariffs plus retaliatory tariffs by other countries caused U.S. imports to decrease 66% and U.S. exports to decrease 61%. Economists and economic historians have a consensus that passing of the Act worsened the effects of the Great Depression.

Trump has a sliding scale on who should be tariffed if he becomes president again. It’s 10%-20% on most countries exporting to the U.S. It’s 60% or higher on the countries he doesn’t like. (I had said previously it was 100%.)

If the U.S. starts putting tariffs on every country, what’s to stop them from putting tariffs on the U.S.? It happened last time Trump was president. Does anyone really think Trump would be able to tell China’s president, Xi Jinping, “Hey, buddy. Sorry, but I gotta put really high tariffs on the goods you export to us. Could you do me a yuge solid and not put tariffs on what we export to you?”

Oh, lord. I just remembered something.

Back in April 2022, Texas Governor Greg Abbott pulled a political stunt of increasing inspections for a week of trucks coming from Mexico. (Click here to start reading the first and there’s a second one a few posts below.) The immediate result is Texas lost hundreds of millions of dollars in revenue but it became $4.23 billion as that rippled outward to all affected companies. The long-term effect is the Canada-USA-Mexico railway that’s trying to get made will go around Texas instead of through it.

In the follow-up post, I referenced a study that said when a car is made, it crosses the US/Canada border seven times during the various stages of production.

If Trump’s tariffs go into effect on Canada and they put tariffs on the U.S., wouldn’t that mean that each car has six tariffs applied to it? Actually, wouldn’t it be a tariff on each crossing that gets progressively larger as the value of the vehicle increases on its way towards completion?

Would it make a difference if the vehicle is considered the property of the company throughout the assembly steps and they just happen to be doing those steps at plants they own in other countries? What if they contract with a company in a different country to do the assembly? Or is it just the fact that it crosses the border means it’s tariffed?

If the determining factor is just the fact that it crosses a border, then that drives up the cost of every car a whole lot more than you or I might be able to afford.

Let’s use a simple example. MSRP will be $49,000 when it’s done. The starting value when it finishes the first step is $7000 and goes up $7000 through each of the remaining six steps. Tariff is 10% each way. (US and Canada put equal tariffs on each other.)

Step 1: Value is $7000. Crosses border first time, incurring the 10% tariff. New cost is $7700.

Step 2 assembly completes, making the value now $14,700. Crosses border with 10% tariff. New cost is $16,170.

Step 3 assembly completes, making the value now $23,170. Crossing tariff makes new cost $25,487.

Step 4: $25,487 + $7000 = $32,487, plus 10% = $35,735.70

Step 5: $35,735.70 + $7000 = $42,735.70, plus 10% = $47,009.27

Step 6: $47,009.27 + $7000 = $54.009.27, plus 10% = $59,410.20

Step 7: $59,410.20 + $7000 = $66.410.20. No further tariffs as long as the car stays in the country assembly was completed in.

A $49K car increases in price by $19,410.20 due to tariffs, a 35% increase.

Wouldn’t we see the same thing as happened during the pandemic? People stop buying new cars and hang onto their existing cars longer. If they have to get a replacement, they get used ones. Next step is auto makers start laying off workers again.

If anyone thinks Trump’s blanket tariffs will be good for the U.S., they have no idea how wrong they are.